Introduction: in recent years, due to the unbalanced development of the sand and stone industry, the sand and stone market is also a combination of ice and fire. In some areas of northeast and southwest, because of the "small scattered" problem of sand and stone enterprises, the sand and stone market is depressed, and the price of sand and stone has been hovering at a low level;In East China, North China, Central China, South China and other regions, has basically completed the integration of resources, sand and stone prices are relatively stable.Since the beginning of this year, with a number of large state-owned enterprises and cement enterprises have "joined", sand industry heat is not reduced.Although the price of sand and stone is slightly volatile, but did not affect the confidence of investors, a large number of newly established sand and stone mining rights are successfully sold at high prices, continuing the industry myth of "stone breaking the sky".

With the local sand market supply and demand tension, mineral resources competition is increasingly white-hot, sand prices continue to go up all the way, gradually became a number of people in the mouth of "crazy stone".In such a context, some central enterprises, local state-owned enterprises have "beach" sand market, in the madness to seize market resources at the same time, but also in the active layout, broaden the industry chain, cement enterprises are one of the most "crazy".According to relevant statistics, China Resources Cement, Zhonglian Cement, South Cement recently obtained the mining rights of a number of mines, Huaxin Cement, Southwest Cement, Yao Bo Cement and other cement enterprises are also staring at the sand and stone mines.

The annual report of cement enterprises in 2020 shows that sand aggregate is gradually becoming an important direction for the extension of industrial chain of some large cement enterprises.Conch cement, for example, will increase aggregate capacity by 3 million tons in 2020.Huaxin Cement will build and put into operation 7 aggregate production lines in Changyang, Quxian and other cities in 2020, with an additional aggregate capacity of 15.5 million tons;Eleven aggregate projects are under construction, and the annual aggregate capacity will reach 200 million tons after completion. In 2021, the aggregate expansion project plans to invest 7.15 billion yuan.Since 2020, CRC has won the mining rights of 6 new aggregate mines, with a total resource reserves of about 922 million tons and a planned annual production capacity of about 51 million tons, which further enriches the group's aggregate resource reserves.

According to statistics, from January to May this year, the major domestic cement enterprises have arranged the sand aggregate plate, construction, planned to build sand aggregate line has reached 74, with a total capacity of 369 million tons.

Relevant data statistics:

◆ On February 2 this year, the Natural Resources and Planning Bureau of Linzhou City, Henan Province publicized the transfer result of Majiangou limestone mine for construction stone in Hengshui Town, Linzhou City, Henan Province. Linzhou Zhonglian New Material Co., Ltd. won the mining right with RMB 80 million.March 2, the natural resources and planning bureau of zongyang county, anhui province publicizes the zongyang county huanggongshan construction stone with tuff mining rights auction hanging transfer situation, zongyang southern materials co., LTD., with 880 million yuan competition for the mine mining rights.On March 3, the natural resources and planning bureau of jianchuan county, yunnan province publicized the sale of the limestone mining right for common building materials in yuhuangshan, qingping, jianchuan county, and huaxin cement (jianchuan) co., LTD won the mining right with 6.2019 million yuan.

Mixer in earlier in October 2020, China resources cement holdings announcement, the company's subsidiaries ZhaoQingRun letter new material co., LTD., with 3.21 billion yuan price to zhaoqing city bureau of natural resources listed online loin mining area in kaixian county seal the transfer of public building granite mineral mining rights, granting fixed number of year for 17 years, mining area of about 1.1736 square kilometers,The resource reserves are about 157 million cubic meters (equivalent to about 425 million tons), and the planned annual capacity is about 11 million cubic meters (equivalent to about 30 million tons).

Recently, China Resources Cement (Wuxuan) Co., Ltd. successfully won the mining right of the project at a price of 160.6 million yuan, according to the release of the release notice of the limestone mine for cement in Shidiai mining area of Wuxuan county, Guangxi.

In zhejiang province on June 7, public resources trading center successful transfer dinghai district jintang openmindedness mountain east and abandoned mines governance openmindedness intelligent container port east openmindedness mountains form a complete set of comprehensive logistics base project construction stone (tuff) ore mining, reached 560 million yuan, has finally been China gezhouba group first engineering co., LTD., with 1.037 billion yuan to buy,The average unit price of resources was 46.86 yuan/ton.

◆ Before that, on May 24, Huzhou Nanfang Mining Co., Ltd. successfully won the cement limestone mine in the comprehensive renovation project adjacent to Dagemushan Mine, Laohutang Mine and Liangmaoshan Mine in Meishan Town, Changxing County, Zhejiang Province, with the initial bid of 1.167 billion yuan and the final bid of 1.187 billion yuan. The average unit price of the resource was 8.16 yuan/ton.According to preliminary statistics, as of June 8, Zhejiang Province this year has been seven consecutive super large sand mining rights to more than 1 billion yuan at a price, a total of 11.6255 billion yuan.

◆ In particular, it is worth mentioning that China National Energy Construction Group, with the advantages of technology and talents cultivated by its subsidiary, China Gezhouba Group Yipli Co., Ltd. in the sand and stone industry for many years, has also started to layout the sand and stone industry and plans to invest 60 billion yuan to develop sand and stone projects in the next 5 years.

According to the relevant analysts, it is expected that the "14 to five" cement enterprise aggregate capacity will exceed 1 billion tons, Hubei, Jiangxi, Guangxi aggregate capacity will achieve double growth.Now the sand and stone mining right is hot, has completely broken the traditional competition pattern, is becoming quite the strength of the central enterprises, cement enterprises and local state-owned enterprises competition target.

"Large state-owned enterprises, cement enterprises have made moves to 'occupy the mountain' behind, there is a more long-term layout."Hu Youyi, president of China Association of Sand and Stone, said that for the cement industry, the "14" profit margin into the bottleneck period, the aggregate industry will become the focus of cement enterprises to expand the direction.Cement industry development sand aggregate industry has a unique innate advantage.On the one hand, cement enterprises have rich mineral resources, cement enterprises existing mining, crushing, screening, material transportation and storage technology, can be used for the production of sand aggregate.Cement and sand and gravel aggregate industry, on the other hand, in the customer, market, mineral resources, technology and equipment, management methods and operation management aspects, such as human resources there are highly complementary and integration advantages, actively layout mechanism of sand, and other areas of the new building materials, can broaden the further development of the industrial chain, foster new competitive advantages and economic growth.

The traditional sand and stone industry is undergoing earth-shaking changes, and the pattern of sand and stone mines dominated by private enterprises in the past has been broken.In the new round of sand and stone industry layout, central enterprises, cement enterprises and local state-owned enterprises are becoming the leading role.

-

Focus Project | With a total investment of 487 million yuan, The customer of Sanming Heavy Industry in Liuzhou, Guangxi will soon build an annual output of 4 million tons of fine sand aggregate production line

Focus Project | With a total investment of 487 million yuan, The customer of Sanming Heavy Industry in Liuzhou, Guangxi will soon build an annual output of 4 million tons of fine sand aggregate production line -

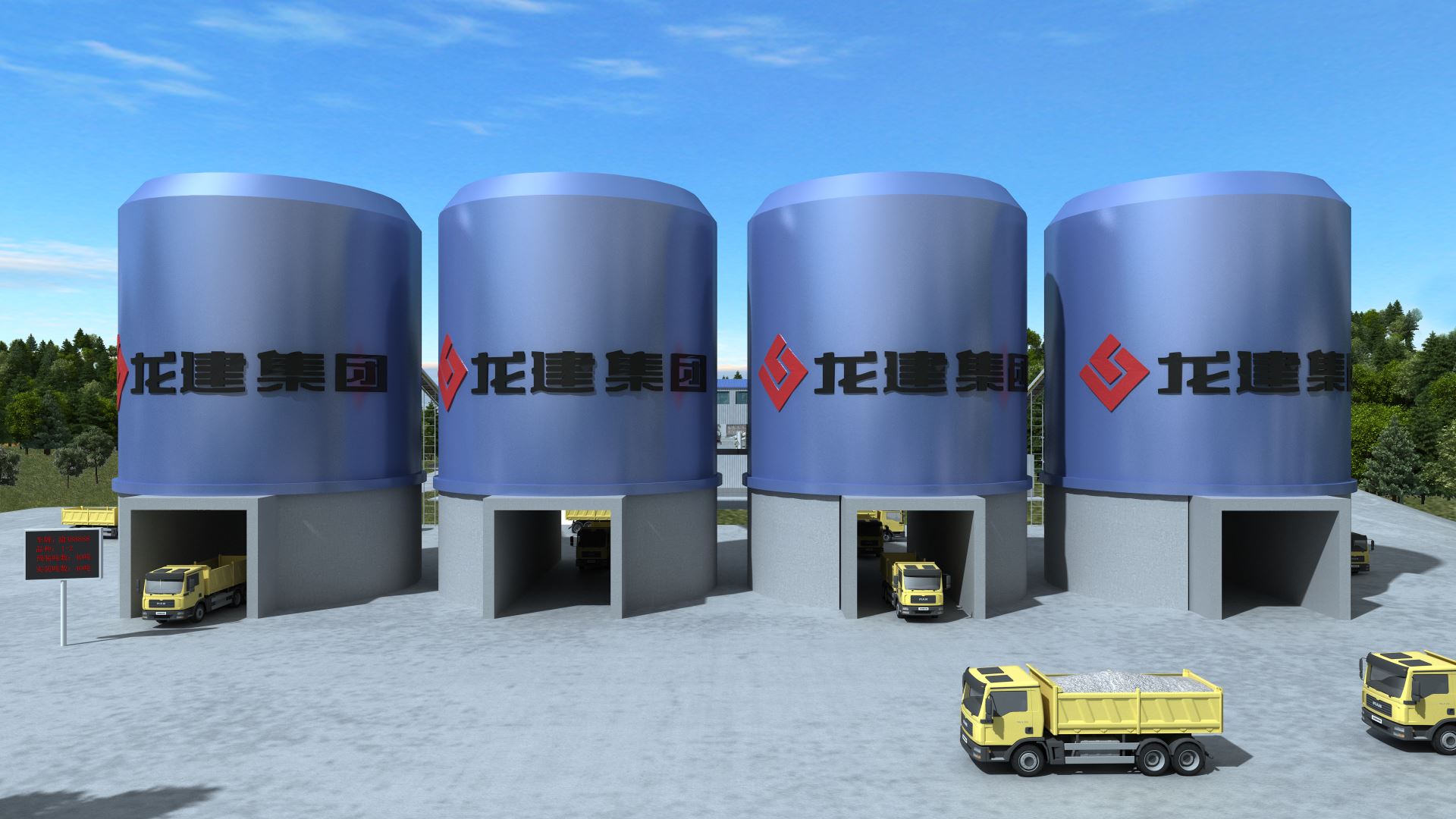

The 2022 Spring Festival holiday notice of Longjian Group

The 2022 Spring Festival holiday notice of Longjian Group -

Longjian Group held a virtual equity incentive promotion meeting in the fourth quarter of 2021

Longjian Group held a virtual equity incentive promotion meeting in the fourth quarter of 2021 -

Hand in hand to build heart to heart | Longjian Group Party branch went to Dashu Village to carry out "Urban and rural branches hand in hand" pair to build donation activities

Hand in hand to build heart to heart | Longjian Group Party branch went to Dashu Village to carry out "Urban and rural branches hand in hand" pair to build donation activities -

.png) Chongqing "Meter" high-speed Railway Network Construction | Full Construction in five years, Full operation in ten years -- Chengdu-Chongqing Middle Line high-speed railway Construction "Acceleration"

Chongqing "Meter" high-speed Railway Network Construction | Full Construction in five years, Full operation in ten years -- Chengdu-Chongqing Middle Line high-speed railway Construction "Acceleration" -

How to create green mines and green factories?

-

In the process of installation and acceptance of equipment of sand and gravel aggregate production line with production capacity of 600 tons at the beginning of construction in Hubei Province

In the process of installation and acceptance of equipment of sand and gravel aggregate production line with production capacity of 600 tons at the beginning of construction in Hubei Province -

Warmly congratulated: Mr. Long Fujian, chairman of the group company, was elected vice president of Chongqing sand and stone association

Warmly congratulated: Mr. Long Fujian, chairman of the group company, was elected vice president of Chongqing sand and stone association